2021 Simple Ira Contribution Limits Over 50

The amount you can contribute to an individual retirement account stays the same for 2021.

2021 simple ira contribution limits over 50. The catch up contribution limit for simple ira plans is 3 000 in 2015 2021. Roth contribution limits while simple ira contributions are capped at an annual limit of 13 500 annual roth ira contribution limits are much lower. The contribution limit for simple 401k and simple ira plans will stay the same at 13 500 in 2021 as in 2020.

Workers age 50 or older can make. For the rest of us ira contribution limits are flat. Simple ira contribution limits vs.

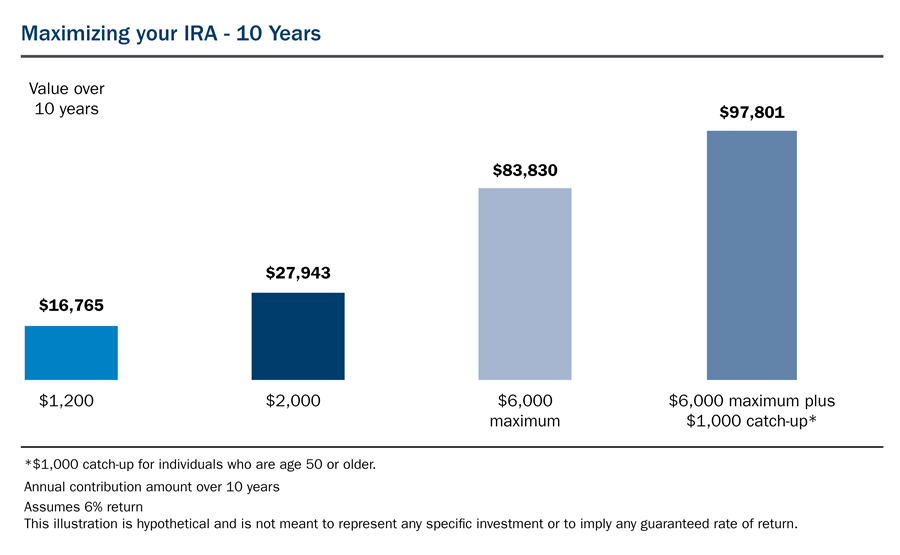

2020 simple ira contribution limits for 2020 the annual contribution limit for simple iras was bumped up to 13 500 that s 500 more than the limit for 2019. 6 000 with a 1 000 catch up limit if you re 50. The ira contribution limit is 6 000.

For 2021 2020 and 2019 the total contributions you make each year to all of your traditional iras and roth iras can t be more than. The contribution limits for simple iras isn t changing from 2020 to 2021 which means workers under 50 can put in up to 13 500 while those 50 and over get a 3 000 catch up that brings their. The irs has released the 2021 contribution limits for retirement plans and other cost of living adjustments.

Information about ira contribution limits. The additional ira catch up contribution for people 50 and over is not subject to an annual cost of living adjustment and stays at 1 000 too for a total contribution limit of 7 000 for ira. The ira catch up contribution limit will remain 1 000 for those age 50 and older.

Unchanged for employees with 401 k 403 b roth 401 k most 457 plans or the federal government s thrift savings plan the contribution limit will remain at 19 500 in 2021. Here are the ira limits for 2021. If permitted by the simple ira plan participants who are age 50 or over at the end of the calendar year can also make catch up contributions.