2021 Hsa Contribution Limits Over 65

Those 55 or older.

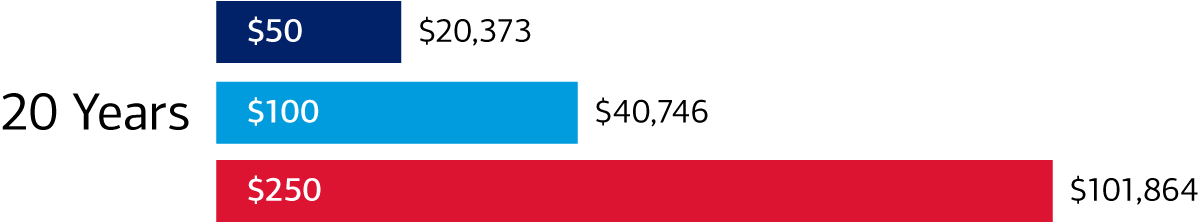

2021 hsa contribution limits over 65. 2020 contribution limit 2021 contribution limit. You can contribute up to 3 600 in 2021 if you have self only coverage or up to 7 200 for family coverage 3 550 and 7 100. Because of covid 19 the irs extended the tax filing deadline to july 15 2020.

So if you turn 65 on june 21 you may not contribute to your hsa after june 1. If your spouse is under age 65 that may provide an avenue for continued hsa contributions. Hsa limits 2021 summary.

The 2020 hsa contribution limit for an individual is 3 600. 55 plus can contribute an extra 1 000. However cannot make hsa contributions into the hsa of an employee s spouse.

The contribution limit which is the total you can contribute in 2018 if you are under 55. They maintain a number of variables chief among them an individual limit a family limit and an age 55 addiitional catch up contribution limit. Finally your contributions to an hsa are limited each year too.

For 2021 that means a plan with a minimum annual deductible of 1 400 for individual coverage or 2 800 for. 1 000 catch up contributions 55 and older before you look too far ahead it s a good idea to make sure you ve maximized your 2019 contributions. Dick and adelle are covered under a family hdhp provided through dick s employer.

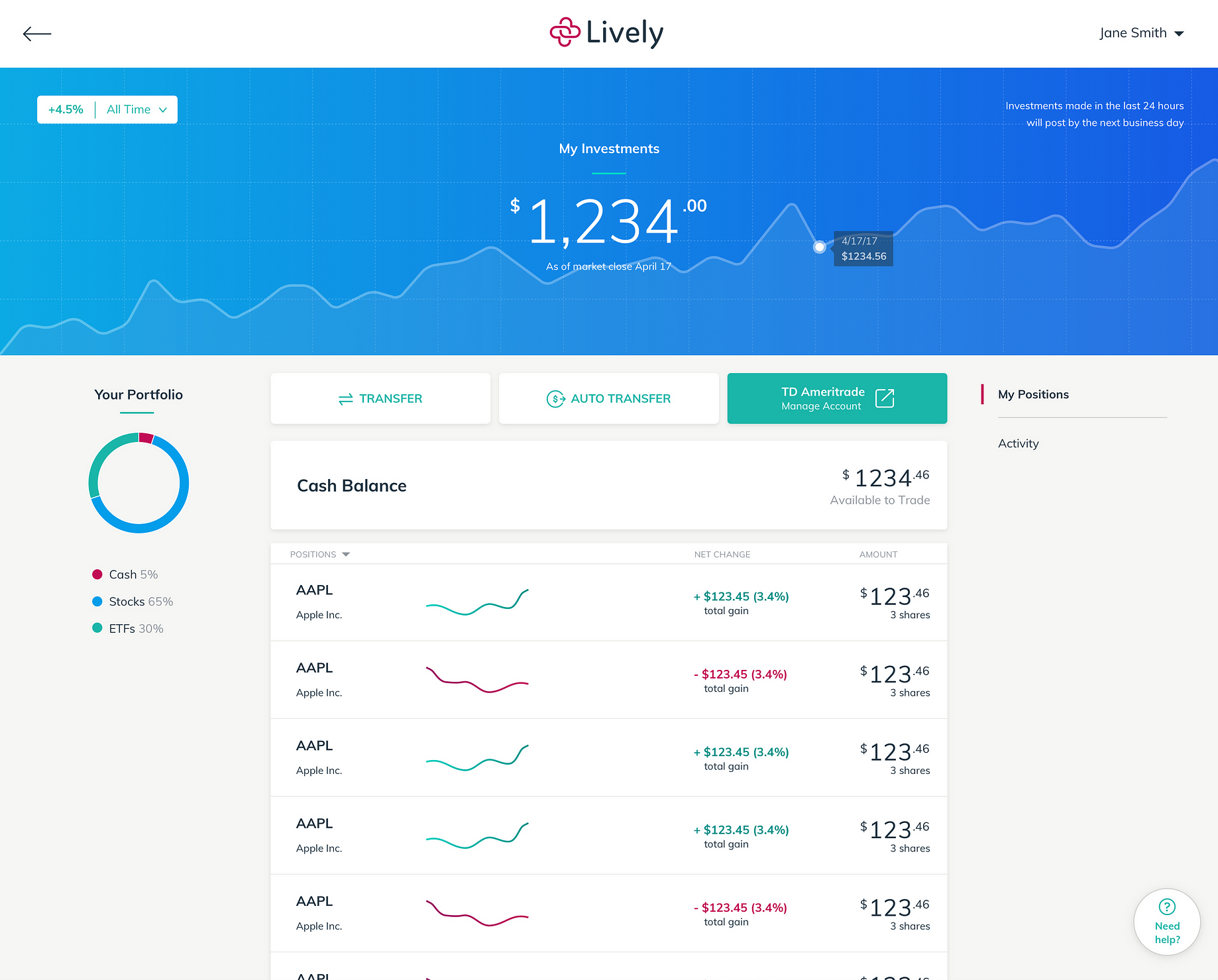

How to make hsa contributions after age 65 if you delay enrolling in medicare you can continue to stash cash in a health savings account. For a family plan the limit is 7 200. Hsa contribution limit for 2021.