2021 Ira Contribution Limits Married Filing Jointly

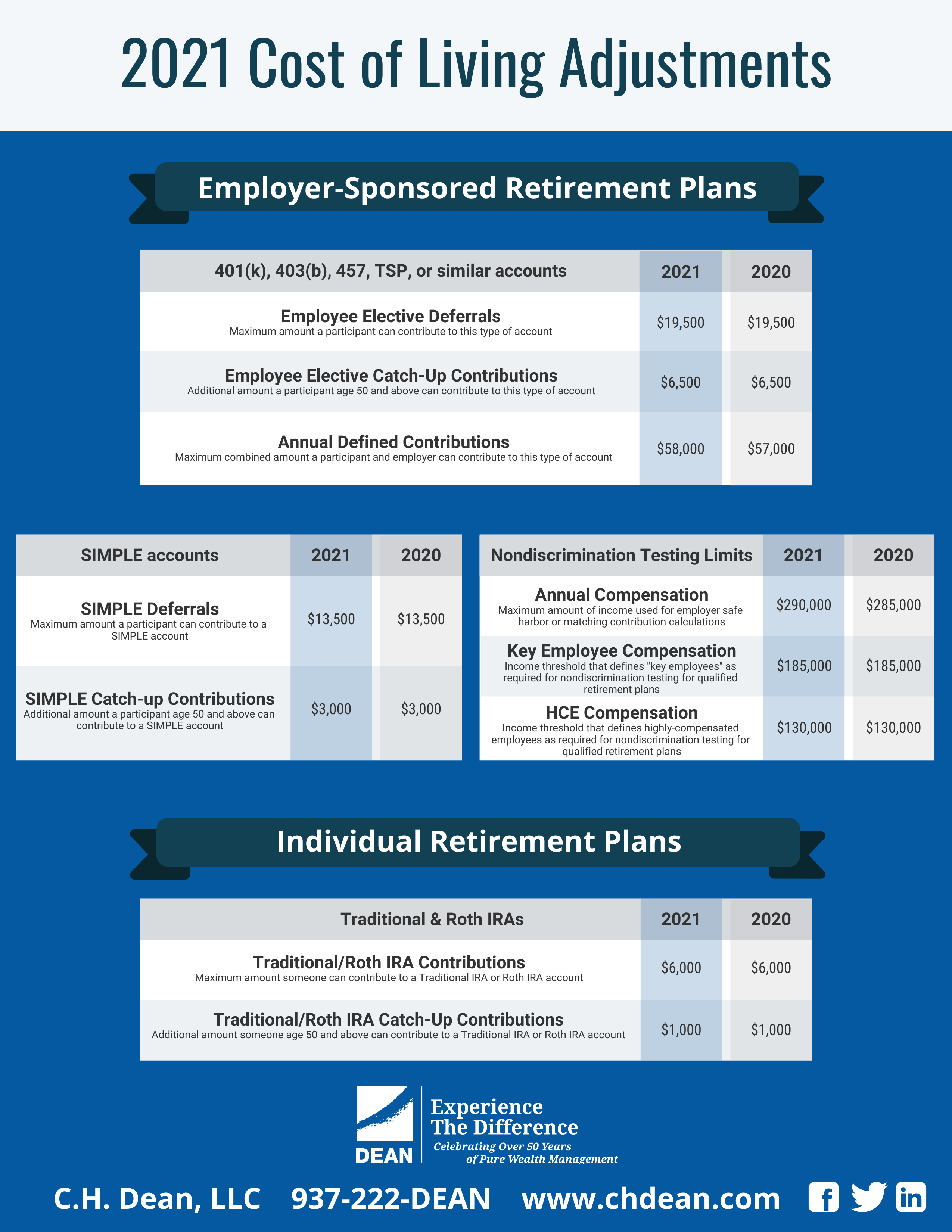

The 2021 limit for contributions to roth and traditional iras is 6 000 or 7 000 if you re age 50 or older.

2021 ira contribution limits married filing jointly. In 2021 eligibility to contribute to a roth ira starts to phase out at 125 000 for single filers and 198 000 for married couples filing jointly. 2021 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 198 000 6 000 7 000 if you re age 50 or older 198 000 to. 66 000 to 76 000 single taxpayers covered by a workplace retirement plan.

Those are slightly higher starts of the phase out thresholds than in 2020 which began at. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional iras by the result in 3. Divide the result in 2 by 15 000 10 000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during the year.

Individual retirement arrangements allow you to save money for retirement in your own tax advantaged account. If you earn between 104 000 and 124 000 as a joint filer you will not be. For married couples filing jointly in which the spouse who makes the ira contribution is covered by a workplace retirement plan the income phase out range is 105 000 to 125 000 for 2021 up.

If you re under 50 you can put in up to 6 000 in 2021. 105 000 to 125 000 for a married couple filing jointly if the spouse making the ira contribution is covered by a workplace retirement plan up from 104 000 to 124 000 in 2020. If you re married rules for ira contributions for married filing jointly come into.

Here are the traditional ira phase out ranges for 2021. This applies when the spouse making the. 105 000 to 125 000 married couples filing jointly.