Roth Ira Contribution Limits 2021

For 2021 2020 and 2019 the total contributions you make each year to all of your traditional iras and roth iras can t be more than.

Roth ira contribution limits 2021. The limit on annual contributions to an individual retirement account pretax or roth or a combination remains at 6 000 for 2021. Up to the limit. How much can you invest.

If you re 50 or older you can contribute an extra 1 000 meaning your limit is 7 000. The annual roth ira contribution limit in 2020 and 2021 is 6 000 for adults under 50 and 7 000 for adults 50 and older. Plan participants ages 50 and older have a contribution limit of 7 000 which is commonly referred to as the catch up contribution.

198 000 but 208 000. 2021 ira contribution limits. Roth ira contribution limits.

Retirement topics ira contribution limits. 6 000 if you re younger than age 50. Then you can contribute.

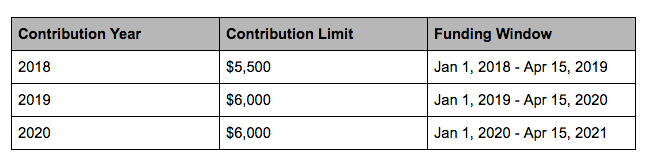

The table below provides a summary of roth ira contribution agi income limits from the irs. If you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000. The maximum annual contribution to roth ira s is generally 5 000 for savers under the age of 50 and 6 000 for savers over 50.

For the 2021 tax season standard roth ira contribution limits remain the same from last year with a 6 000 limit for individuals. Married filing separately and you lived with your spouse at any time during the year. 7 000 if you re aged 50 or older.