Roth Ira Contribution Limits 2021 Over 50

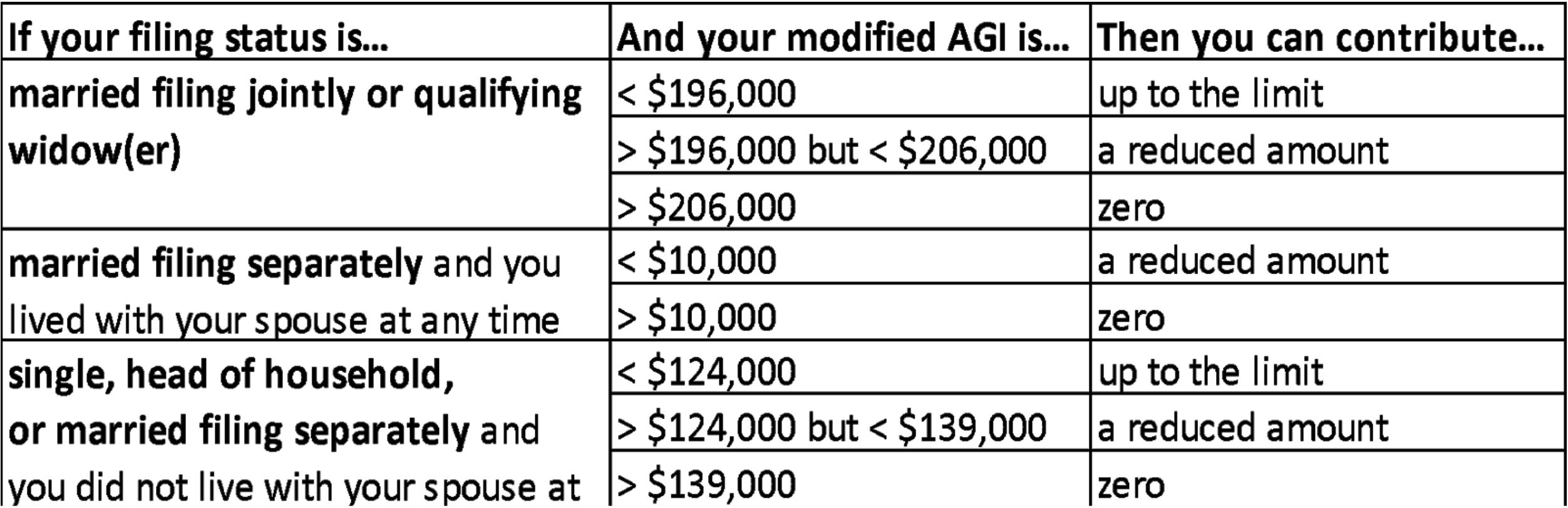

Subtract from the amount in 1.

Roth ira contribution limits 2021 over 50. But there are other factors that could place further limits on how much. Information about ira contribution limits. Ira contribution limits for traditional and roth accounts in 2021 will be the same as 2020 s.

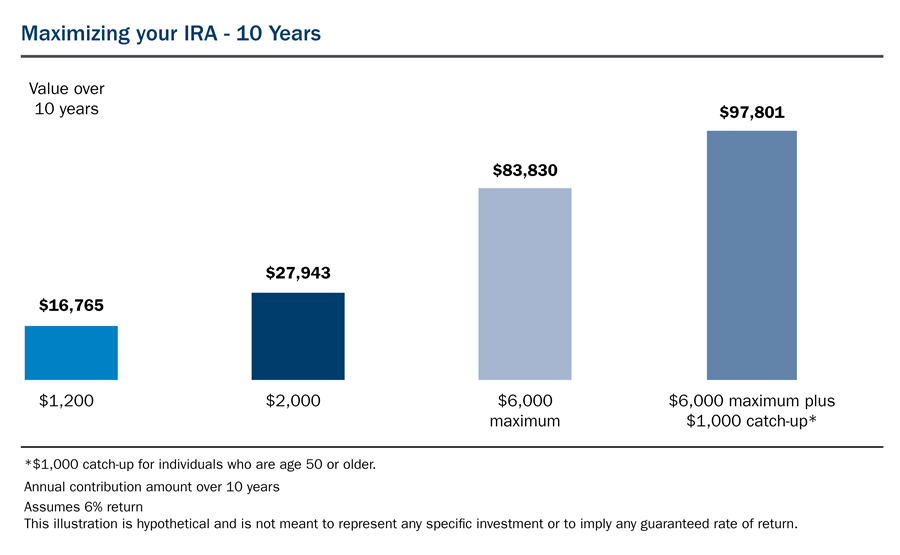

For the rest of us ira contribution limits are flat. The table below provides a summary of roth ira contribution agi income limits from the irs. The ira contribution limit is 6 000.

The ira catch up contribution limit will remain 1 000 for those age 50 and older. If you re under 50 you can put in up to 6 000 in 2021. If you re 50 or older you get a 1 000 catch.

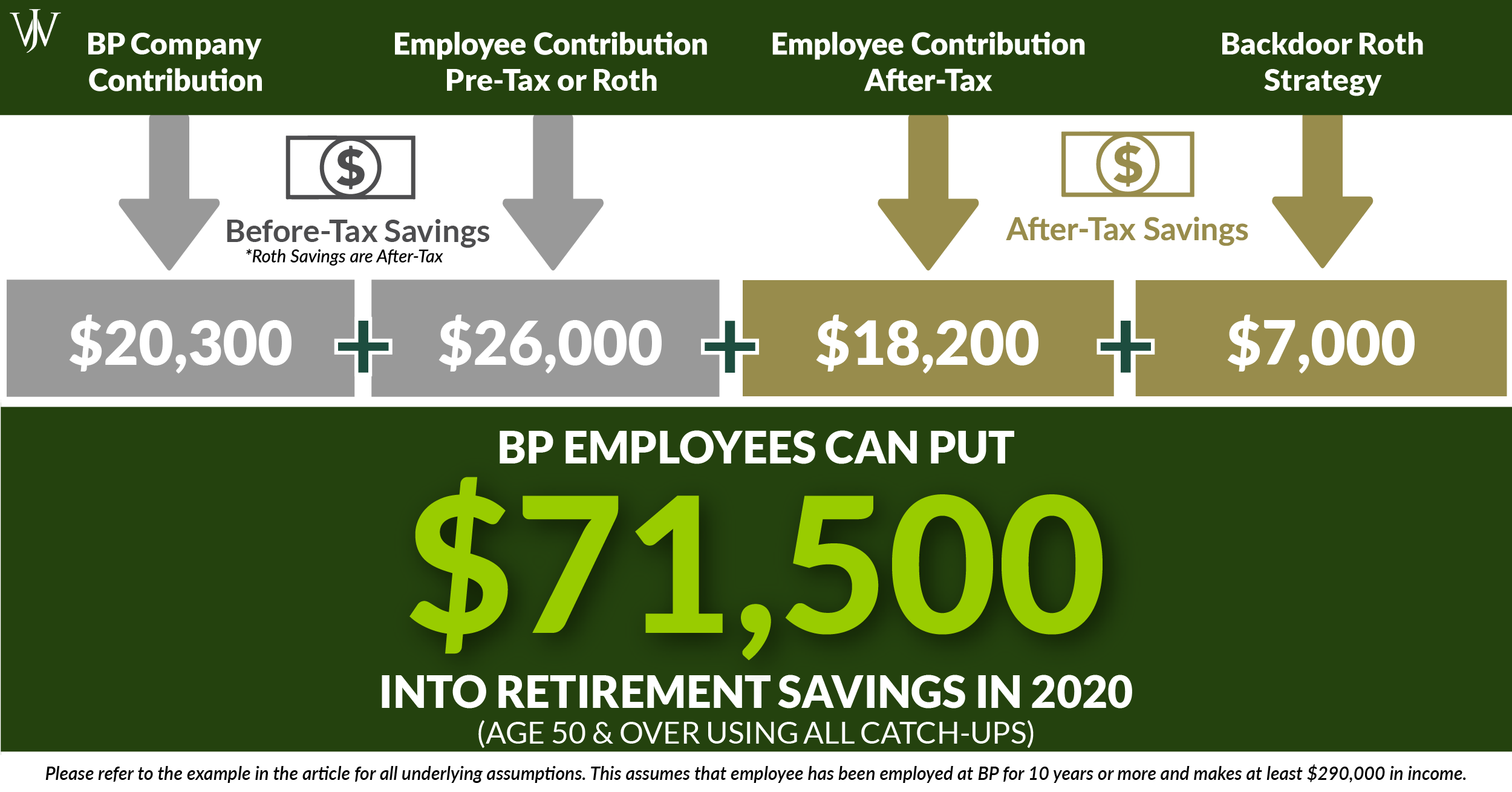

401 k participants with incomes below. Here are the ira limits for 2021. How much can you invest.

6 000 with a 1 000 catch up limit if you re 50. The annual roth ira contribution limit in 2020 and 2021 is 6 000 for adults under 50 and 7 000 for adults 50 and older. Roth ira contribution limits.

6 500 for a total of 26 000 ira limits individual retirement accounts also give you a tax break upfront with taxes deferred. Learn about tax deductions iras and work. Start with your modified agi.