2021 Ira Contribution Limits Over 50

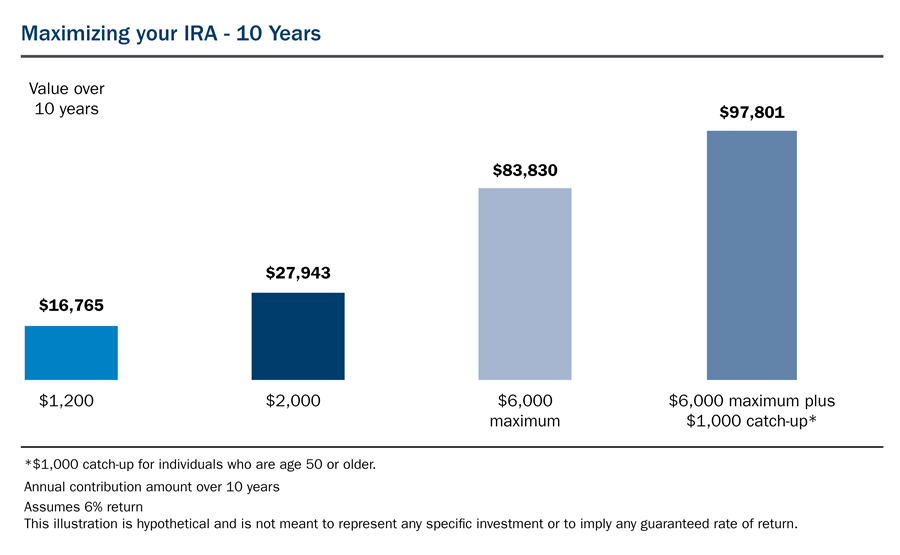

The amount you can contribute to an individual retirement account stays the same for 2021.

2021 ira contribution limits over 50. The ira contribution limits are adjusted by the internal revenue service. Taxpayers 50 and older can make a catch up contribution of an additional 1 000. For 2021 it is anticipated that the contribution limit will increase to 6 500 for those who are under the age of 50.

If you re under 50 you can put in up to 6 000 in 2021. Workers age 50 and older can make an extra 1 000 catch up contribution to an ira in 2021 for a maximum possible ira contribution of 7 000 in 2021. Ira contribution limits for traditional and roth accounts in 2021 will be the same as 2020 s.

For 2021 2020 and 2019 the total contributions you make each year to all of your traditional iras and roth iras can t be more than. The ira catch up contribution limit for 2021. The catch up contribution limit for employees age 50 or older who participate in these plans also holds steady in 2021 at 6 500 for a total contribution limit of 26 000 for employees 50 and.

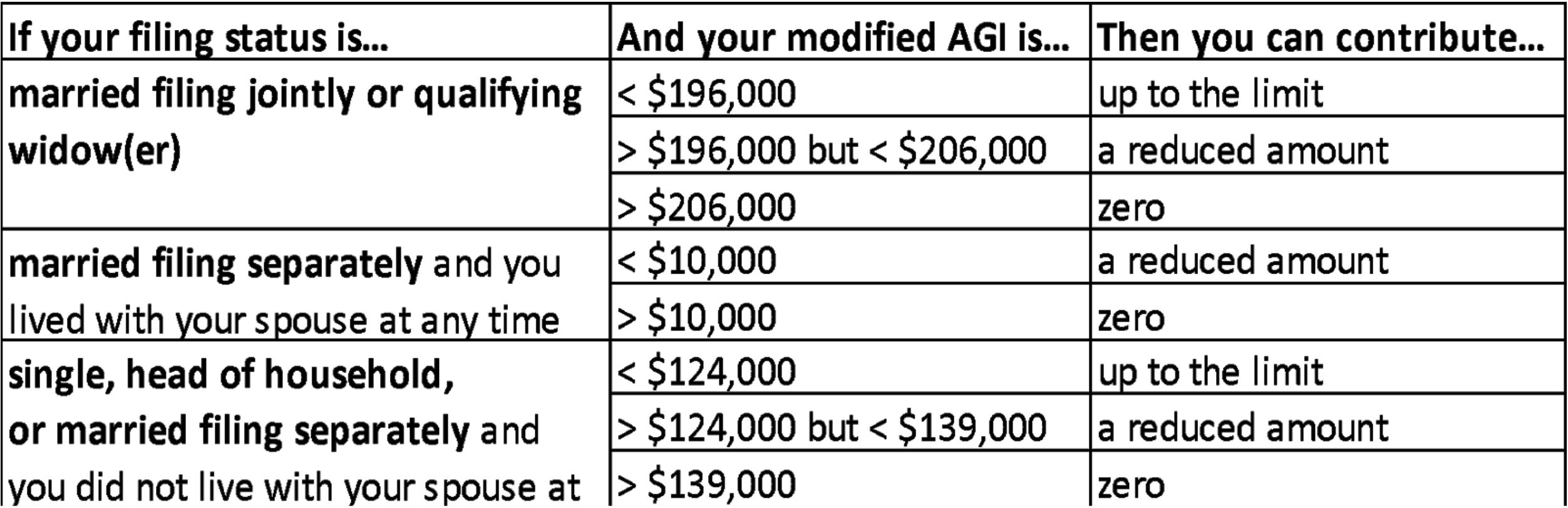

But there are restrictions that. Though the contribution limits remain largely unchanged the income ranges to be eligible to make roth ira. The 2021 limit for contributions to roth and traditional iras is 6 000 or 7 000 if you re age 50 or older remaining unchanged from 2020.

Roth ira income limits are increasing in 2021. If you re 50 or older you get a 1 000 catch. Ira contribution limit 2021.

If you re over the age of 50 the. Those over 50 can contribute an extra 1 000 to traditional and roth iras in 2021. 6 000 7 000 if you re age 50 or older or.