2021 Hsa Contribution Limits Over 50

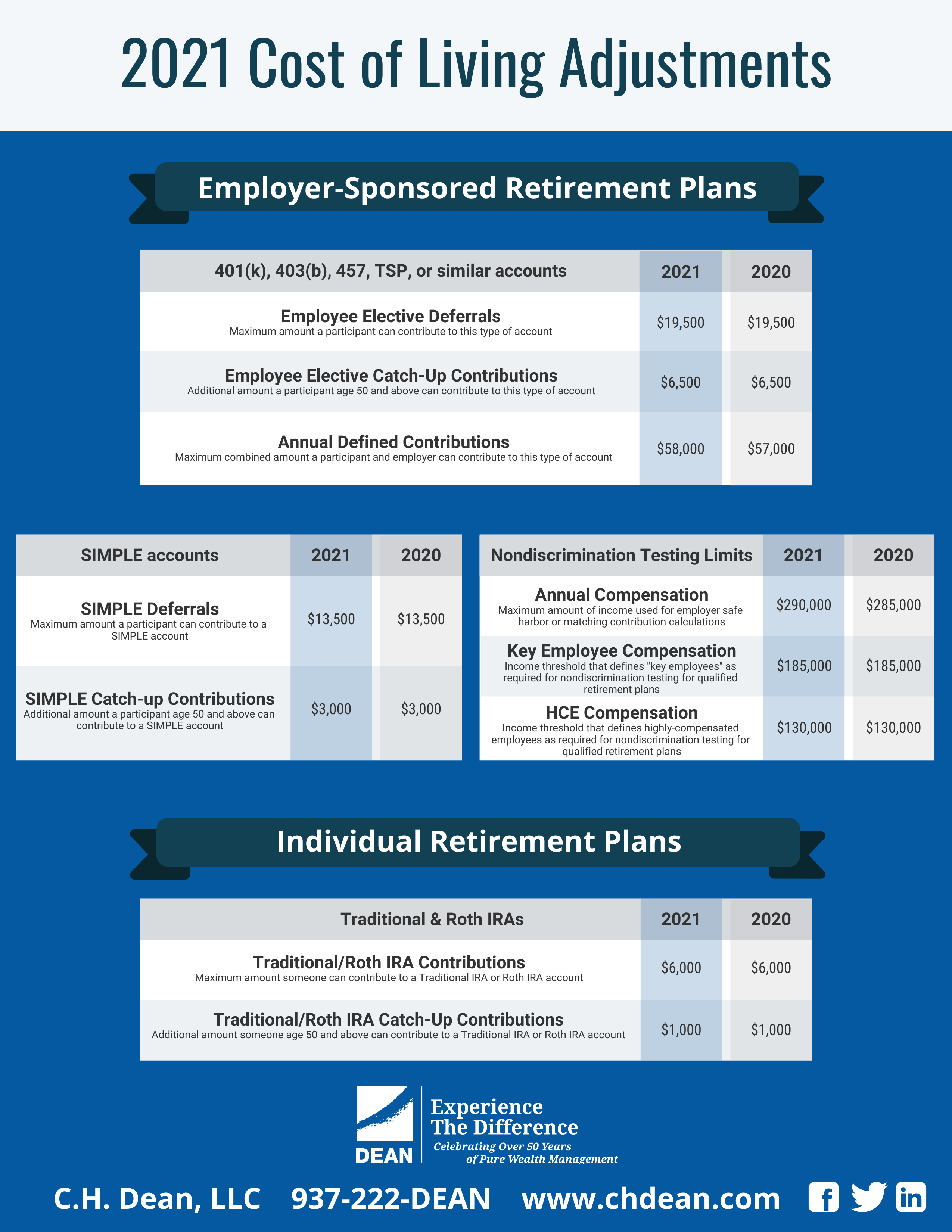

2021 hsa contribution limits 2020 for 2020 your individual 401 k contribution limit is 19 500 or 26 000 if you re age 50 or older.

2021 hsa contribution limits over 50. Annual hsa contribution limit for individuals in 2021 the annual hsa contribution limit will rise to 3 600 for individuals in a high deductible plan the irs said. For participants age 50 and over the additional 401 k catch up contribution limit which is set by law is staying at 6 500 for 2021. The internal revenue service announced new higher contribution limits for health savings accounts for 2021 today.

An hsa helps those with high deductible health plans save taxes on money earmarked for medical expenses not covered by the plan. The limits on annual deductibles are also subject to annual inflation adjustments. If you re already maxing out your 401 k or other retirement contributions you might consider putting pre tax dollars toward an hsa health savings account if you have one.

2021 maximum hsa contributions 3 600 individual 7 200 family 1 000 catch up contributions 55 and older. For family coverage the numbers are minimum 2 800 in annual deductible and no more than 14 000 in annual out of pocket expenses. 2021 hsa contribution limits increase.

Even if you don t turn 50 until december 31 2021 you can make the. 2021 hsa contribution limits 2020. Annual contribution limits have increased for 2021 by 50 for individual plans and 100 for family plans.

The catch up contribution limit for employees age 50 or older in these plans also remains steady. For 2021 the annual limit on deductible contributions is 3 600 for individuals with self only coverage under an hdhp a 50 increase from 2020 and 7 200 for family coverage a 100 increase from 2020.