2021 Hsa Contribution Limits Irs

For 2021 the hsa contribution limits have increased due to inflation.

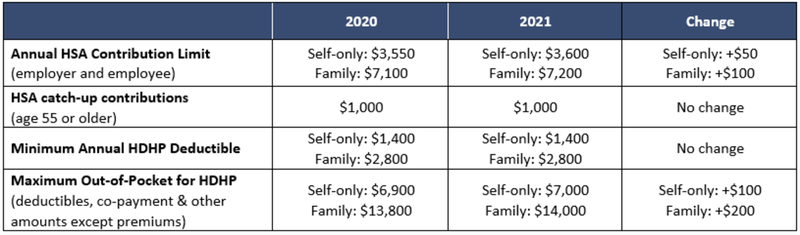

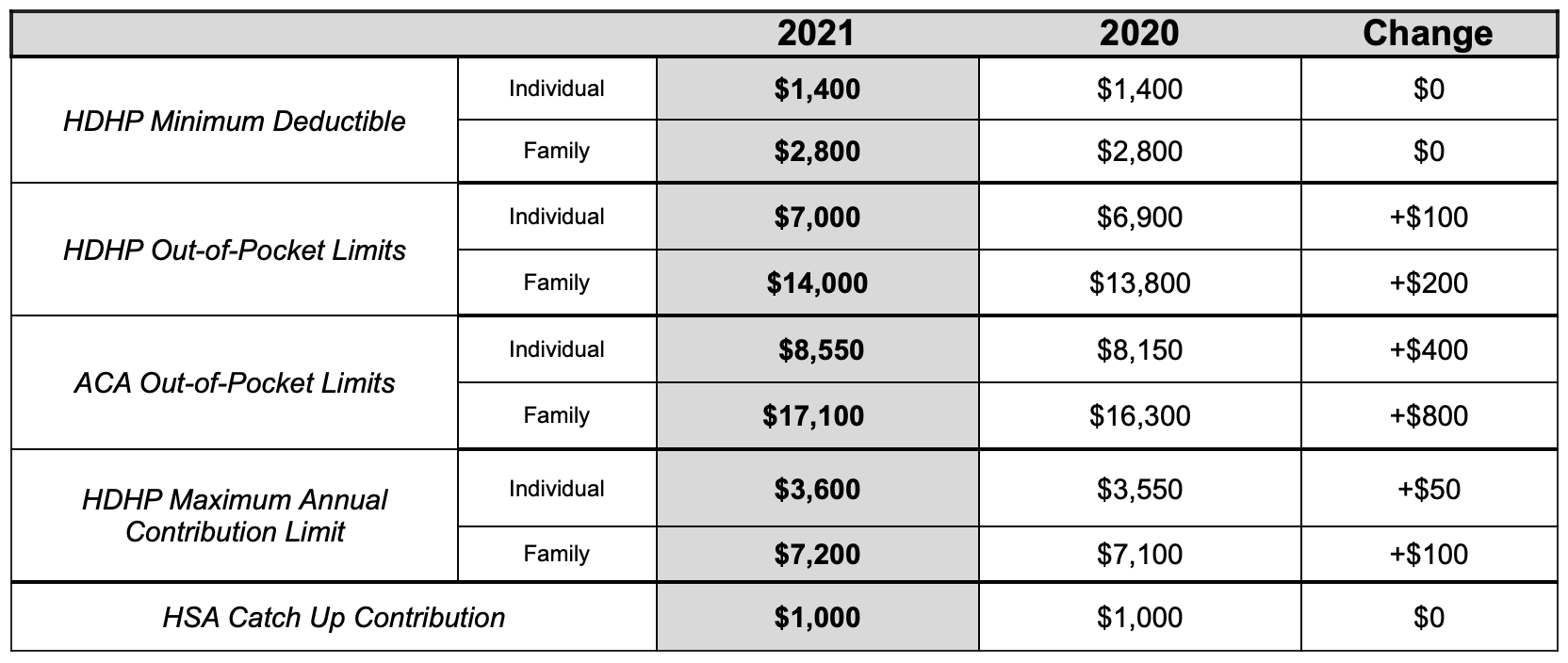

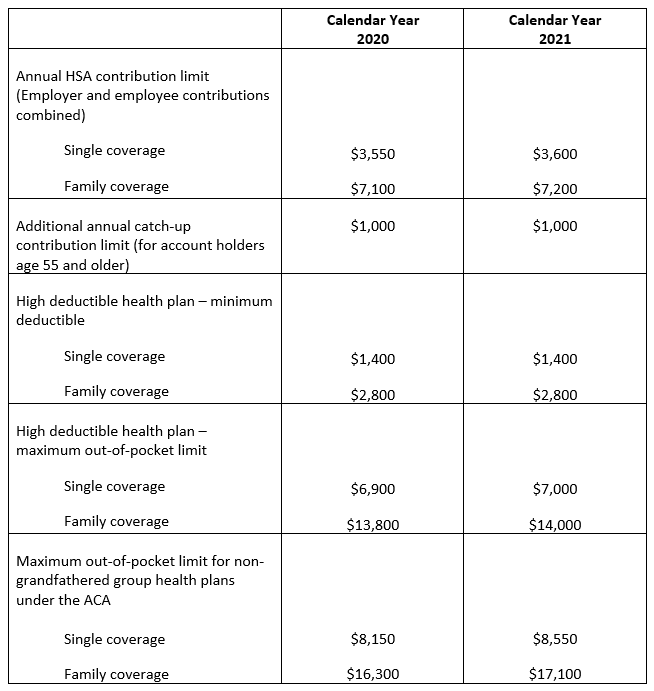

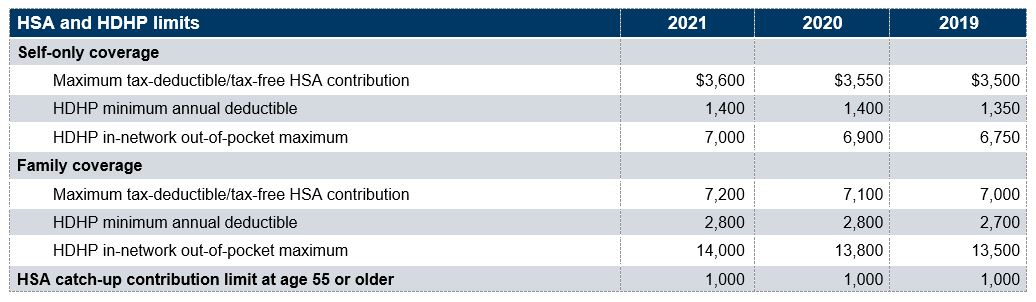

2021 hsa contribution limits irs. 223 individuals who participate in an hdhp are permitted a deduction for contributions to hsas set up to help pay their medical. Here are the details. Hsa contribution limits for 2021 will go up from 3 550 individual to 3 600 and family contributions will increase from 7 100 to 7 200.

The 2021 annual hsa contribution limit is 3 600 for individuals with self only hdhp coverage up from 3 550 in 2020 and 7 200 for individuals with family hdhp coverage up from 7 100 in 2020. The irs in rev. Here is what you need to know about the hsa contribution limits for the 2021 calendar year.

2020 32 announced the annual inflation adjusted limits on deductions for contributions to a health savings account hsa allowed for taxpayers with family coverage under a high deductible health plan hdhp for calendar year 2021. 2021 hsa contribution limits. For those with family coverage the new limit is 7 200 a 100 annual increase.

The irs announced an increase in health savings account hsa contribution limits for the 2021 tax year. For 2021 that means a plan with a minimum annual deductible of 1 400 for individual coverage or 2 800 for. With total hsa accounts now exceeding 28 million with more than 66 billion in assets the annual contribution limit announcement is one of the most highly anticipated in the benefits world and one that could directly affect how account holders fund their accounts in the.

You can contribute to an hsa if you re in a qualifying high deductible health plan. The irs has continued its busy few weeks of new notices and updates with the release of hsa contribution limits for 2021. An individual with self only coverage under an hdhp can contribute up to 3 600 a 50 increase.

2021 hsa contribution limits. Irs increases hsa contribution limits for 2021 the internal revenue service irs issued its annual health savings account contribution adjustment on wednesday may 20 for 2021 at a time when many taxpayers are worried about their health in the midst of the novel coronavirus pandemic.