2021 Budget Tax Rates

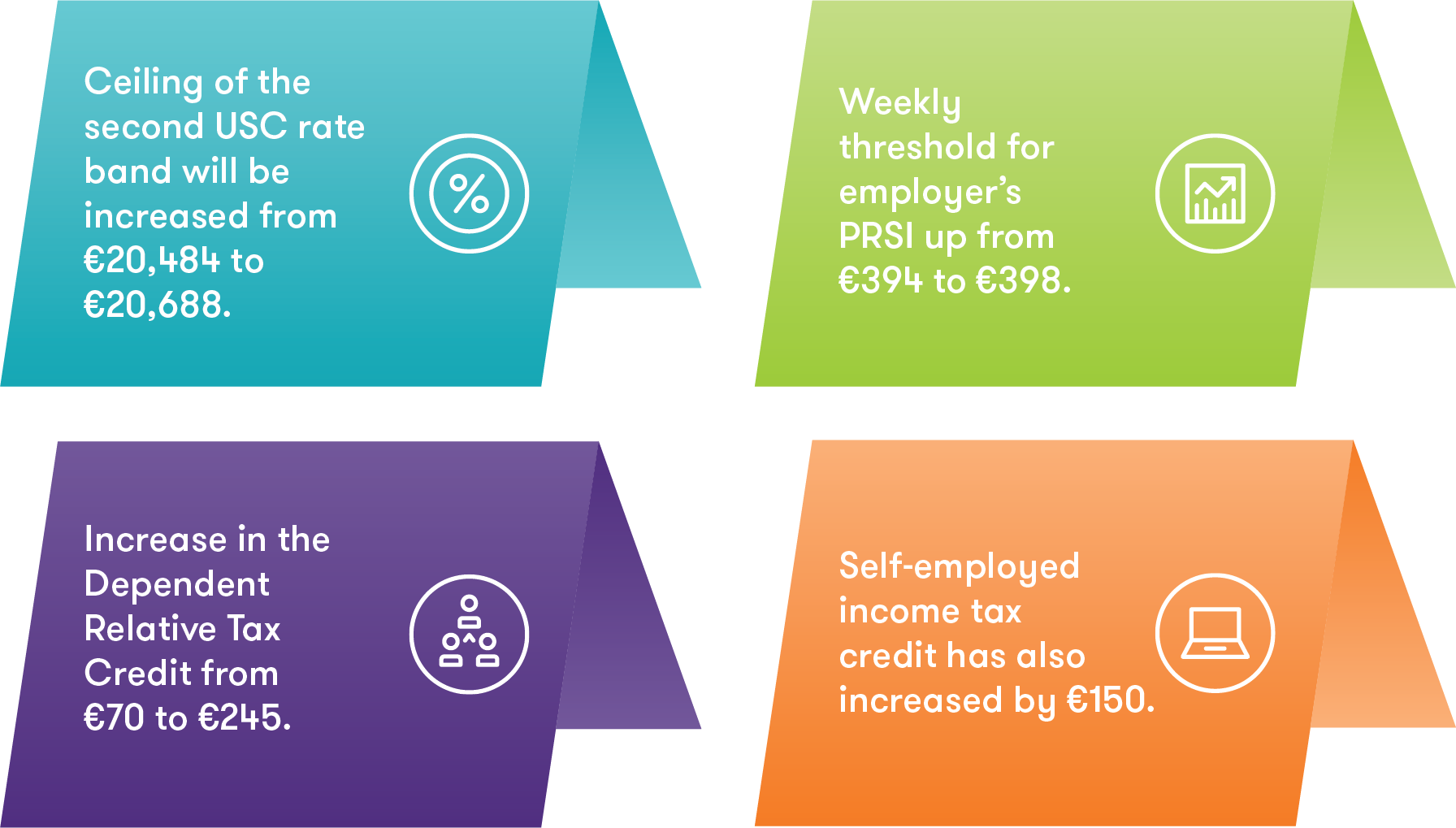

All these are relatively small increases from 2020.

2021 budget tax rates. The maximum credit is 3 618 for one child 5 980 for two children and 6 728 for three or more children. 203 increase to 20 484 band ceiling to 20 687 the increase in the 2 rate band ceiling will ensure that a full time adult worker who benefits from the increase in the hourly minimum wage rate from 10 10 to 10 20 will remain outside the top rates of usc. With the full implementation of the new emissions testing system wltp from january next a new structure of rates and bands for vrt and motor tax.

Trusts other than special trusts will be taxed at a flat rate of 45. In changes announced in budget 2020 on 6 october 2020 the 1 july 2022 adjustments were brought forward to apply from 1 july 2020. Tax rates 2020 2021 taxable income tax on this income 0 18 200 nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 180 000 29 467 plus.

Budget 2021 was announced on tuesday 13 october 2020. Yo can find a summary of the announcements on this page. The earned income tax credit for the self employed will increase from 1 500 to 1 650.

The supply of certain goods and services to which the rate of 13 5 currently applies will be liable to vat at 9 from 1 november 2020 until 31 december 2021. This new structure sees an increase in the number of vrt bands to 20 with a wider gap between the highest and lowest vrt rate 7 to 37. The rates were modified rates to lift the 32 5 rate ceiling from 87 000 to 90 000 in the 4 years from 1 july 2018 to 30 june 2022 with further adjustments from 1 july 2022 and 2024.

2021 earned income tax credit the maximum earned income tax credit in 2021 for single and joint filers is 543 if the filer has no children table 5. Media oks neutral tax rate in 2021 budget dec 20 2020 8 hrs ago comments facebook twitter whatsapp sms email medianews group file photo facebook twitter whatsapp sms email print save by susan l.