2021 Acura Tlx Depreciation

The first acura sedan fully designed around the brand s precision crafted performance ethos with a model exclusive body structure and chassis architecture all turbocharged engine lineup and an athletic stance with bold proportions the new tlx delivers dramatic.

2021 acura tlx depreciation. The depreciation fee is the amount you ll pay each month in depreciation. If you have a 36 month lease on a car that has 5 000 in depreciation over the life of the lease each month you ll pay just under 140 in depreciation fees. For 2021 the base model tlx gains a new engine that s nearly as powerful as the now discontinued tlx v6.

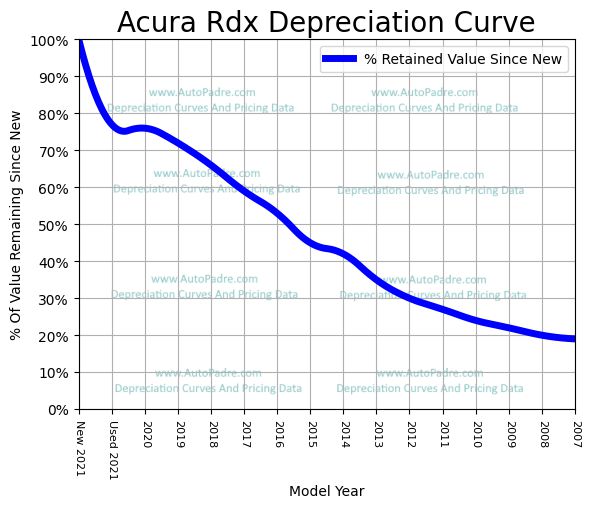

An acura rdx will depreciate 54 after 5 years and have a 5 year resale value of 18 967. The first acura sedan fully designed around the brand s precision crafted performance ethos with a model exclusive body structure and chassis architecture all turbocharged engine lineup and an athletic stance with bold proportions the new tlx delivers dramatic. Depending on dealer discounts local tax laws incentives and your own knack for negotiating you can get a great deal which will be your final offer price.

Use our depreciation calculator tool to predict estimated resale values and find the best model years to buy for the acura tlx here. You ll also see the total cost of the lease. The acura rdx fares better than its bigger brother the mdx but is still in the middle of the pack among luxury models.

The 2021 acura tlx carries an msrp of 37 000 for the base trim. Compare specs features cost of ownership etc. About our data and useful lifespan we aggregate and analyze millions of automotive data points from a variety of sources including some of the industry s leading data providers.

Acura has revealed its quickest best handling and most well appointed sedan in its 35 year history the all new 2021 acura tlx. Compare details of the 2021 acura tlx technology package 4dr sh awd sedan side by side against other vehicles. The 2021 acura tlx true cost to own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership.